Rygnestad

UK

Risk

Analysis

Kristin

Hild

Home

About

Services

Contact

History

Risk Analysis

The scope of a risk analysis is to go beyond a "Best-Case vs. Most Likely vs. Worst-Case" approach and apply simulation modelling with Monte Carlo sampling. Risk analyses always require working in close cooperation with senior management and technical experts to identify and quantify project risks.

Example 1:

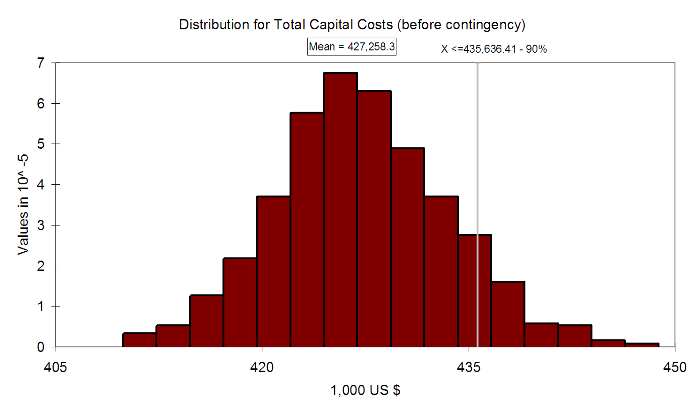

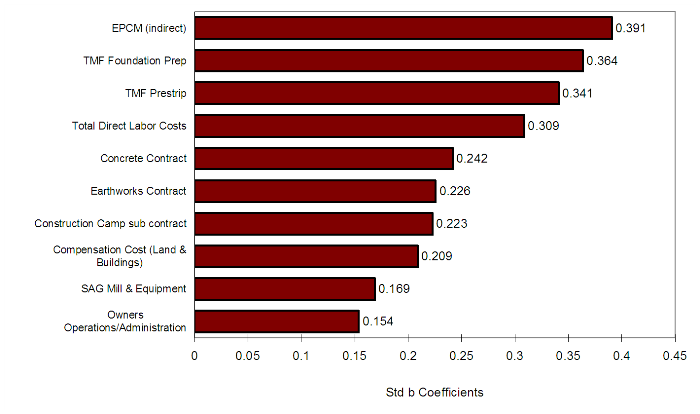

I develop Monte Carlo simulation models with @RISK to determine the required contingency level for mining and other captial investment projects. The analysis integrated costs of mining, processing, tailings disposal, and other initial capital expenses such as relocation of several nearby villages and owners costs.

Hover your mouse pointer over the images to the right to see samples of output charts: probability distribution for total capital costs, and tornado chart of key cost factors.

Example 2:

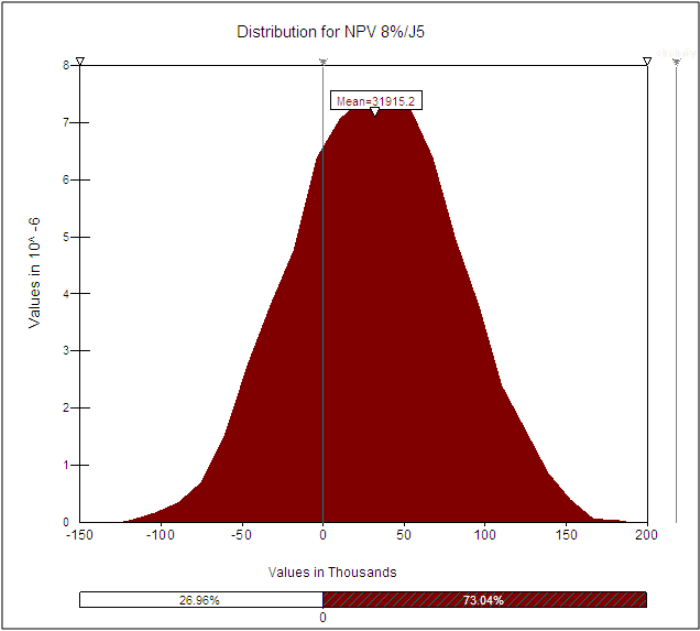

I use @Risk to incorporate Monte Carlo simulation in financial models with the aim to quantify how key factors affect the project's net present value and internal rate of return.

Hover your mouse pointer over the images to the right to see samples of output chart: probability distribution for net present value at 8% dicount rate.

Example 3:

I have prepared hands-on sessions for a risk analysis training course for project managers. The participants were guided step-by-step through several Monte Carlo simulation models using two different risk analysis software packages. Using Macromedia Captivate I converted the course to an online resource for the client's internal use.

Client Login (password required):

|

Risk Course |

Internal

|

Web design by

Hild Rygnestad

Last updated November 2025

Copyright © Rygnestad UK - All Rights Reserved